personal property tax rate richmond va

Yearly median tax in Richmond City. No other tangible personal property tax rate shall be applied to that portion of the value of each.

Virginia S Personal Property Taxes On The Rise 13newsnow Com

As expected the Richmond City Council on Tuesday passed an extension that will give taxpayers until June 1 to pay their personal property tax bills in full.

. Tax amount varies by county. With an average effective property tax rate of 080 Virginia property taxes come in well below the national average of 107. Be totally or permanently disabled.

Team Papergov 1 year ago. Tax Rate per 100 of assessed value Albemarle County 434 296-5856. The median property tax also known as real estate tax in Richmond city is 212600 per year based on a median home value of 20180000 and a median effective property tax rate of 105 of property.

Personal Property Registration Form An ANNUAL. Richmond VA 23225 804 230-1212. Personal Property Tax Relief 581-3523.

There are certain requirements they must meet to qualify for the tax relief programs. As used in this chapter. This information pertains to tax rates for Richmond VA and surrounding Counties.

Broad Street Richmond VA. The current rate is 350 per 100 of assessed value. In city of richmond the reassessment process takes place every two years.

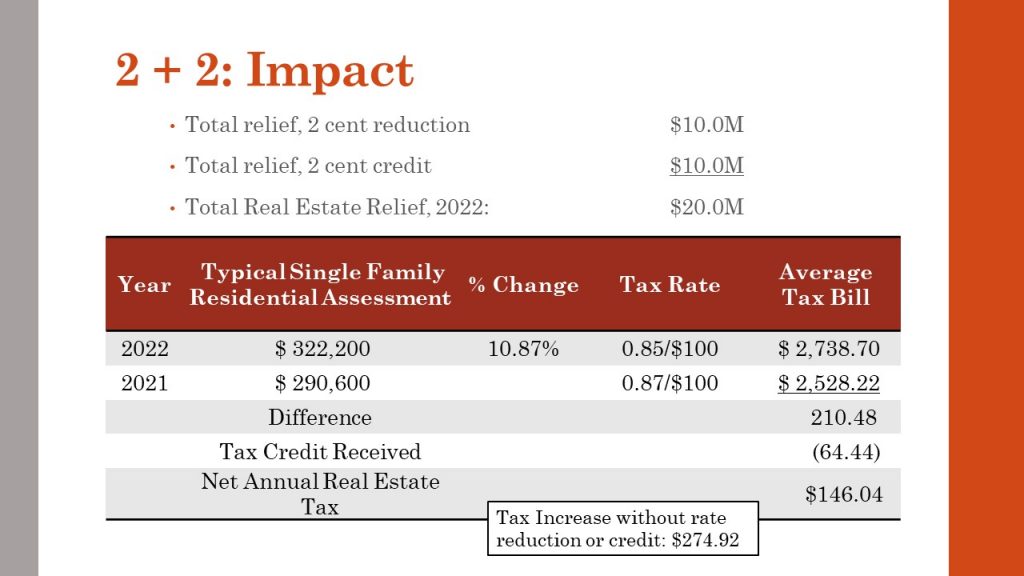

Be 65 or older. Tax rates differ depending on where you live. Meanwhile Foster is also disappointed with the emphasis on the real estate tax rate compared to personal property.

It is estimated that by freezing the rate the city will provide Richmonders more than 8 million in. 49 for 2020 x 69480 34045. Counties in Virginia collect an average of.

Studying this recap youll get a good understanding of real property taxes in Richmond and what you should be aware of when your propertys appraised value is set. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. The personal property tax is calculated by multiplying the assessed value by the tax rate.

WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the payments. Real Estate and Personal Property Taxes Online Payment. Own and reside in the property being taxed.

Electronic Check ACHEFT 095. 074 of home value. And city officials say corrected.

Have an income lower. Personal Property Taxes are billed once a year with a December 5 th due date. If you are contemplating moving there.

Vehicle License Tax Vehicles. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Since home values in many parts of Virginia are very high though Virginia.

Car Tax Credit -PPTR. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Richmond City collects on average 105 of a.

Depending on your vehicles value you may save up to 150 more because the city is freezing the rate. The personal property tax rate is determined. The personal property tax is calculated by multiplying the assessed value by the tax rate.

The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts excluding the rental of vehicles licensed by the state from rental of personal property for 92. Henricos personal property tax rate the lowest in the Richmond area is 350 per 100 assessed value. 295 with a minimum of 100.

The median property tax in Virginia is 186200 per year for a home worth the median value of 25260000.

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

News Flash Chesterfield County Va Civicengage

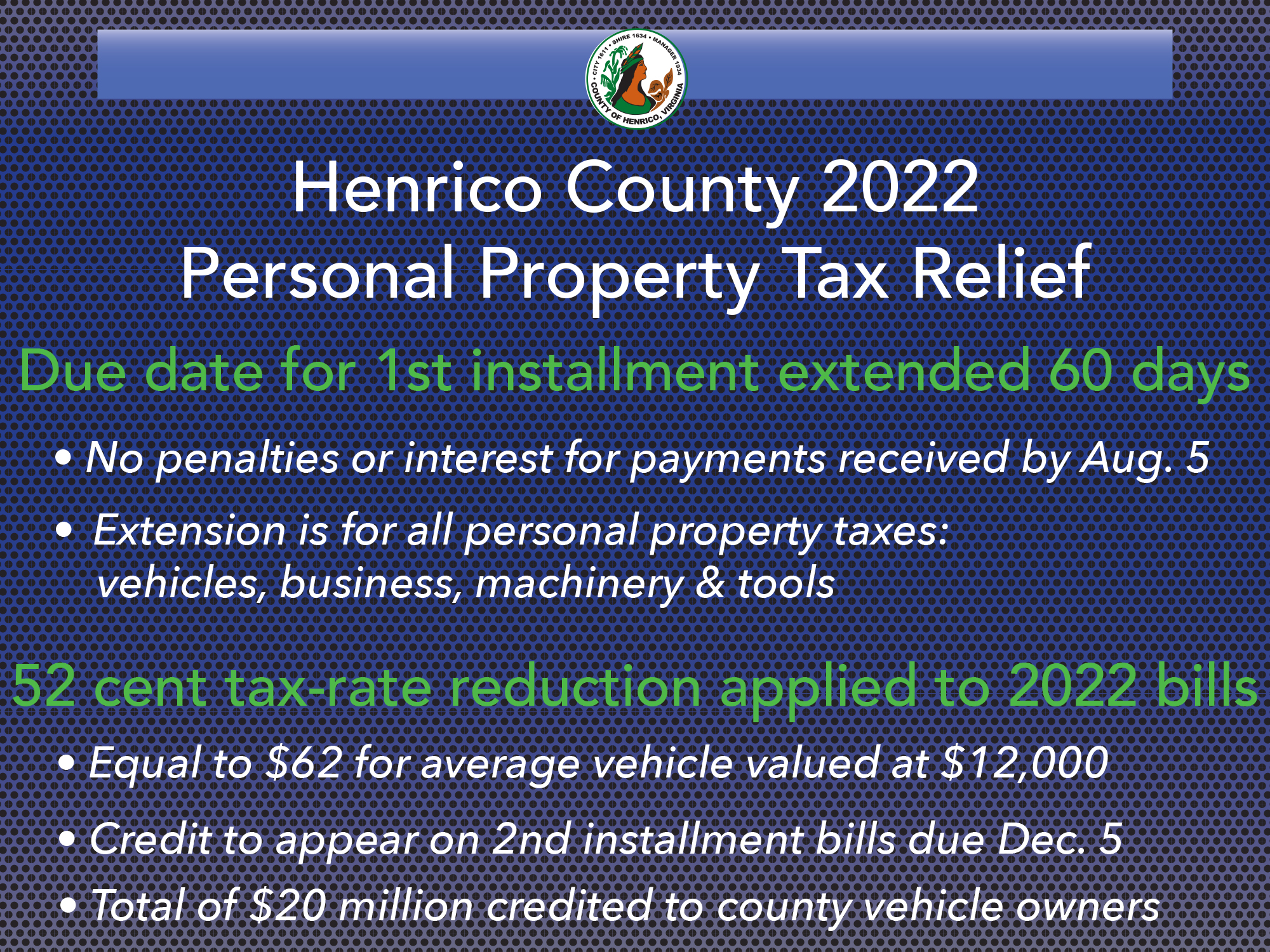

Henrico Leaders Push Back Personal Property Tax Deadline

Henrico Issues Emergency Ordinance Extending Personal Property Tax Deadline Wric Abc 8news

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

/cloudfront-us-east-1.images.arcpublishing.com/gray/WPM3BLSOYBGB7DP3Q4DS2QXRUU.png)

Chesterfield Provides Grace Period On Personal Property Tax Payments

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

Pay Online Chesterfield County Va

Henrico Leaders To Vote On Personal Property Tax Bill Extension

Henrico Returns Extra Tax Revenue Not The County S Money

News Flash Goochland County Va Civicengage

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

Henrico County Announces Plans On Personal Property Tax Relief

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia